Introduction

As with any other industry involved in financial services, banking depends on customers’ trust and patronage. The specificity and differentiation of the customer experience are imperative for a bank in the digital world. CRM Solutions for Enhancing Banking Services enable the banking industry to help them provide better services and optimize their operations. These solutions alter how banks systematically operate in the direction of customer relationships and trust building. With the help of CRM, financial institutions can reorient their strategies according to new tendencies of customers’ demands.

Why CRM is Critical to Banking Services

Customers share data with their banks daily. Handling this data enhances the interaction between customers and the provision of service. CRM systems eliminate many activities that would otherwise confuse the banking systems, enabling the relevant authorities to concentrate more on customer satisfaction. They pertain to issues such as slow reaction and institutionalized provision of services. Every client settled by an organization demands a one-on-one conversation, which helps customer retention, especially in highly saturated finance industries. The incorporation of CRM enables better communication and holding of customer relations by the banks.

Different operations also benefit from lower operational costs since automation characterizes most CRM solutions. These tools improve efficiency and reduce time, thus improving service delivery. Moreover, these tools guarantee that the company is legitimate and compliant with financial regulations. In the context of the gradual transformation of the banking industry, CRM solutions have become necessary for continuing to compete.

Effective characteristics of banking CRM solutions

For CRM to be implemented effectively in banks, solutions must meet specific characteristics. These tools must have functional and efficient data storage functionalities to perform the intended analyses. They allow banks to categorize, sort, and manage customer information efficiently.

Customer personalization is an integral part of CRM programs. Because of this, when a bank has its customers categorized, it can accord any of them the right offer or service. Thereby enhancing consumer interaction and satisfaction. These also reduce work cycles as most customer data management processes are automated and include data entry, follow-ups, and others.

Current integration with mobile apps, websites, and ATMs of the banking channels is crucial. Therefore, it makes delivering homogeneity in customer interaction easier despite several touchpoints. Security is one of the most notable impacts on CRM solutions, and fatigue must be given to protect financial information.

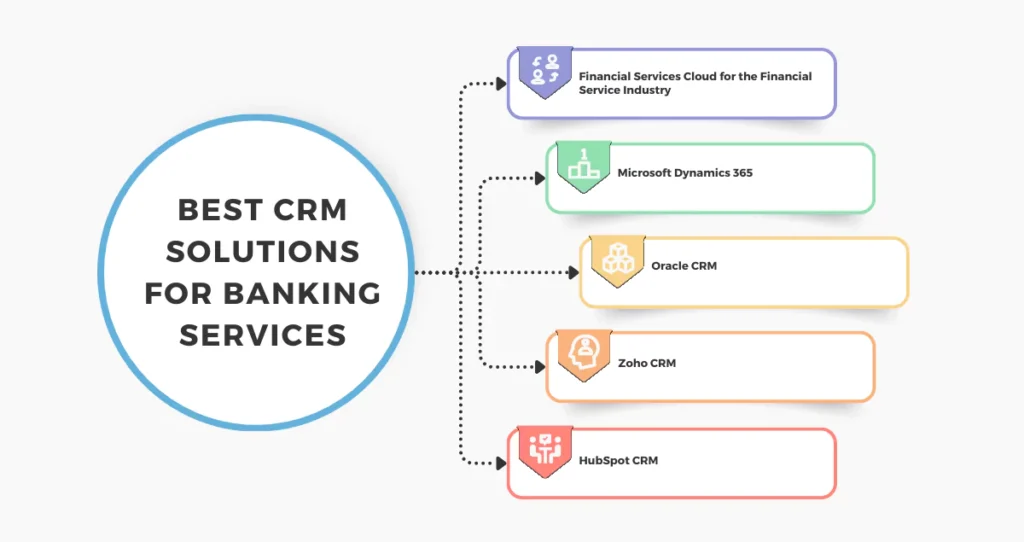

Best CRM Solutions for Banking Services

The market presents a wide range of practical CRM applications and tools designed especially for the banking sector. Here are some of the best options to consider:

1. Financial Services Cloud for the Financial Service Industry

Salesforce deals with CRM solutions in different sectors, such as banking. It has a Financial Services Cloud that provides its clients with client onboarding, insight generation and reporting, and account management. One area where the platform performs exceptionally well is in nurturing individual client engagements.

2. Microsoft Dynamics 365

Microsoft Dynamics 365 is an integrated solution comprising CRM and ERP features. It has real-time data analysis, thus enabling banking institutions to make relevant decisions. Compliance with other tools in the Microsoft suite improves the workflow. Microsoft tools optimize work processes when connected to other programs.

3. Oracle CRM

Oracle CRM is all about scale, automation, and artificial intelligence in customer engagement. Analysts use it to forecast customers’ requirements, consumption patterns and payment tendencies. The platform is especially suitable for an institution with many customers in its database.

4. Zoho CRM

Regarding the many features offered by Zoho CRM, the product is relatively cheap, while user convenience and efficiency are extraordinarily high. One of the features is Lead Management; it also displays e-mail Integration and Real-time Notifications. The platform is most suitable for small to midsize banks who are cost-conscious.

5. HubSpot CRM

The tools that come with HubSpot CRM are extensive and powerful marketing tools included. Banks can use it to lure and maintain consumers and cut expenses within the bank. All these solutions meet the specific needs of banking. Banks need now to assess which of them better fit their needs to make that decision.

The importance of using CRM in the delivery of banking services

Implementing CRM solutions is docketed to bring several benefits to the banking industry. The ability to better retain customers is the first significant benefit associated with the importance of customer experience. Personalization helps to create better interactions with the tendencies of customers to stick to a particular brand.

Customer relationship management systems help to improve productivity since they allow for the automation of many processes. They can leave usual and routine tasks behind and dedicate more time to work on a wide range of customer problems. This leads to quick identification of the requested queries and, thereby, high customer satisfaction.

The analytical tools and functionalities embedded in the CRM solutions help the banks discover cross-selling and up-selling opportunities. It has been seen that they have an impact on enhancing the revenue and customer value through the targeted offerings. Trust is another important area that CRM enhance. Building consistent and transparent communication that establishes customer trust. That trust builds the base of long-term banking relations.

Upgrade your customer experience today—engage Rozi Academy to help your bank undertake the optimal CRM strategy!

A Guide to Selecting the Appropriate CRM Solution for a Banking Enterprise

The decision on which CRM solution to implement is not easy to make. Before making decisions, banks must assess the current goals and the customers’ needs. There is also the issue of scalability. The CRM that will be chosen must be able to grow with the bank without the scaling down of other services.

Another factor that was used in the assessment is ease of use. Complex systems act as a demotivating factor among employees to put into practice the systems. Such a CRM is easy to adopt and operate, making the overall work smooth. These include integration capabilities as well, just as in other architectures. CRM should integrate with other banking systems and other tools that are available in the industry.

Another determinant is the cost, which is concerned with the firm’s budget constraints and the overall costs compared to benefits. When selecting CRM, banks should be cautious when deciding between affordability and the features provided to the customer. You should try several platforms using a free trial or a demo. Another helpful piece of information can be the review or testimonial of some random user, which can be found on forums. By doing so, the objectives of the opt will be met, the general overall solutions decision will be improved, and banks’ services will be banged.

Do not keep pumping with old frameworks. Contact Rozi Academy now and transform your banking services with CRM!

Rozi Academy: Your Partner in CRM Integration

At Rozi Academy, we understand how beneficial CRM is in the banking industry. Our team also focuses on CRM consultation and integration to guarantee that their transition will be seamless for your institution. For the banking sector, they provide services that are easily adapted to banking systems worldwide.

We offer our services in configuring top-notch CRM systems that include Salesforce, Microsoft Dynamics, and Zoho CRM. We provide consultancy services and guidance to your workforce to maximize the functionality of these channels. At Rozi Academy, we aim to ensure your success through dependable and effective CRM integration solutions.

Join us to transform your banking services. Do not let yourself guess through the data management systems. Let our specialists help you to choose and employ the most effective CRM systems. Combined, we can change how your bank communicates and interacts with its customers.

Conclusion

Today, CRM Solutions for Enhancing Banking Services have become a necessity for surviving and sustaining business in the highly charging world of competition. They make work easier, enhance client interactions, and build credibility. With the help of CRM, banks can create remarkable experiences that help them gain customer loyalty and increase sales. Check all the CRM systems presented in more detail to identify the best solution for your bank. Every website and application have its conveniences in responding to different banking requirements. Recall that choosing the proper CRM will help you reinvent your customer relationships and increase organizational performance.

Are you looking for an opportunity to enhance your business’s productivity and customer satisfaction? Let the experts at Rozi Academy assist you with your CRM integration process—contact us now!